Savings Techniques for Women Who Can't Save

This article about my favorite Japanese personal finance book is part of Frugal Food Month. While it's not directly about food, I hope it's of interest to Just Hungry readers anyway!

Previously, I wrote about some household budget management tools and methods which are fairly standard in Japanese society. While I've known all about these things for years - the kakeibo household ledger, the envelope management method, and so on - I had a hard time following these methods myself for a very long time. As a result, my personal savings have always been on the meager side, to put it mildly.

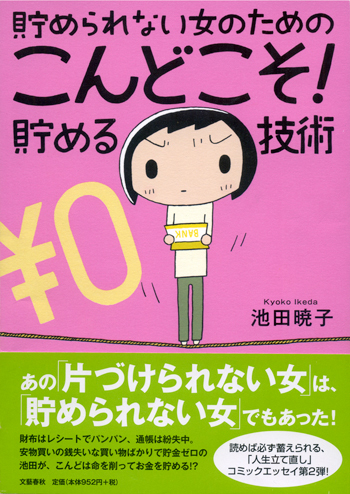

It actually took a small book that I picked up a couple of years ago to make me really see the light. The book is called Finally This Time! Savings Techniques for Women Who Can't Save (貯められない女のためのこんどこそ!貯める技術). It's actually a manga (comic) book. In Japan, it's quite common for difficult concepts to be explained with manga. And what's more important to really understand than how to manage your money?

The book starts by recounting how the author, Kyoko Ikeda, was totally unable to accumulate any kind of savings. One day she discovers that she only has about 11,000 yen in the bank (roughly US $110 at current exchange rates), and that has to last her for 10 days until her next client payment (she's a freelance illustrator and manga artist) is due in. She somehow manages to make it through those ten days, and goes to the bank fully expecting the client payment to be in...and it isn't. She has a serious moment of panic, especially when she goes home and tries to get online - and she can't. Has her internet already been cut off due to nonpayment? What is she going to do? What about the rent that's due?

She survives that crisis when the payment is credited to her account later that day. Some time later, she goes to a class reunion, where she talks to a former classmate who not only have bought their own home already, but has paid off the mortgage. She realizes that she's single, in her late 30s, has no savings or any kind of assets to her name, and is always living from payment to payment, walking a financial tightrope.

She wonders, where has all the money gone? It's not like she hasn't been earning a good income. Her basic expenses like rent are not that high either. She doesn't buy expensive clothes or accessories, or go on lots of trips. When she really analyzes her past spending habits, she realizes that she's just been frittering her money away. Where did it go: On things like an expensive computer she really couldn't afford (on 'easy monthly payments' of course); lessons for things she was all fired up to learn, but never followed through on; equipment and stuff for hobbies soon abandoned. She also has a habit of comforting herself with food (chocolate, an ice cream sundae, a nice curry at the local restaurant...) or little trivial, non-lasting purchases (Aromatherapy! Miracle skincare products!) Finally, she's also always fighting clutter and disorganization at home, and constantly buying new organizing gear - more shelves, more boxes, more...

Does any of this sound familiar to you? To me, it was almost like reading about myself, especially the parts about using small purchases to make myself feel better. And getting frustrated with all the clutter and going out to buy more and more organizing gear. Oh, and the part about spending too much on computer stuff too. And the supplies for soon-abandoned hobbies (ouch!). And the lesson fees for half-finished courses (ouch again!). And, and... The similarities were quite shocking.

Keeping it simple

Of course, it wouldn't be a personal finance book without solutions. What made sense to me was that she kept it very simple.

- Every month, she'd subtract her fixed costs - rent, utilities, and so on from her income.

- The rest, she withdrew as cash and divided up into envelopes (see the envelope method described previously). She made a strict pact with herself never to let one envelope/category "borrow" from another; e.g. if her entertainment expenses envelope ran out, no transferring from her office supplies envelope!

- She kept a kakeibo (household ledger), but didn't use a commercially available one, since she found the categories to be too complicated. She just used a regular notebook, using 2 pages per week, and used broad categorizations that fit her lifestyle and spending patterns. One that made a lot of sense to me is that she divided her food spending into 'food for survival' and 'food for comfort/entertainment' categories. Things like eggs, milk, vegetables were 'food for survival'; chocolate, cake, or eating out for the sake of eating out were 'food for comfort/entertainment'. Most if not all Japanese pre-printed kakeibo divid 'food' into too many categories (carb, protein, vegetables, etc) which can get tedious to keep track of.

- Instead of writing down what she spent, she just stuck down her receipts and wrote down the totals.

- She got rid of unplanned spending. Whenever she wanted to buy something, she would write down her requirements first, and carry the notes around until she found something that fit.

- She had a couple of variations on the coin saving scheme. First of all, whenever she could she paid with bills rather than coins, so she'd always end up with change. Then any change, especially 'big' change (500 yen coins) left at the end of the day was put into the coin jar. (That would be easier to duplicate in countries that have big-denomination coins; here in Switzerland I try 5 franc and 2 franc coins. In the US, you could try quarters, those elusive dollar coins, or even $1 and $5 bills.) At the end of the month, the contents of the coin jar were deposited into a separate savings account, at a different savings institution from her regular bank (she chose the post office).

Decluttering leads to saving

Ms. Ikeda's best known books are actually about decluttering and organization. I picked those up before getting to her savings book. In any case, she says, and I agree from my own experience, and decluttering your personal space leads to saving money too. Not only do you stop wasting money on duplicate purchases (10 pairs of scissors because you keep misplacing them, etc.) but clearing your physical space seems to clear your mental space too.

So, has it worked for me?

Since reading this book as well as her decluttering books, I can say that I have improved my personal finances quite a bit, as well as decluttered my environment and life. It's been a small yet significant factor in leading to the situation I'm in now, looking for an ideal place to live and work, with just enough funds to make that choice. So I'd say it has worked, and is continuing to work.

Ms. Ikeda has a lot of other ideas in her little book, some of which go a bit too far for me (like when she determines that white flour is the cheapest carb, and tries to live on udon, okonomiyaki, and so on). But I truly love this book. Maybe it should be translated into English! In any case I've tried to cover the highlights of the book here. If you do read Japanese at all, and have problems with saving money, I highly recommend it. Besides being practical, it's very cute and funny too, and while the title says 'For Women Who Can't Save' it's just as useful for men too I think. (Her organizing and decluttering books are just as good, if not even better. If you all are interested I'll try to describe them also in an upcoming post. She's also published a couple of books on investing in stocks, and new one on dieting, but I haven't read those yet.)

(Note: a related post on my language blog about a term she uses often...that leads to a lot of wasteful spending!)

Filed under: books and media essays japanese favorites budgeting